You are here

Support the foundation

Would you like to organise an event

or a commemoration for the benefit of Synergie Lyon Cancer?

Donations, sponsoring and taxation...

to go further :

Synergie Lyon Cancer, acknowledged as an organisation working for the public good, is authorised to receive donations and legacies and appeal for public charity.

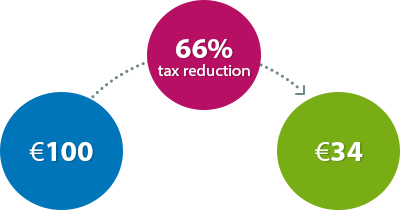

Donations made to foundationsrecognised as working for the public good are eligible for tax reductions. You will receive a tax voucher that you can use to deduct your donation from your taxes.

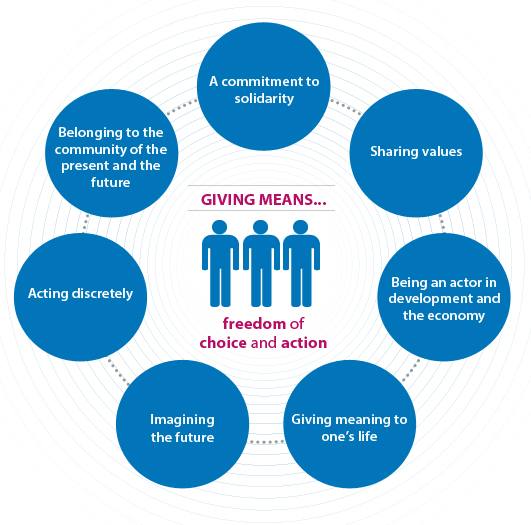

Your donation will allow you to support existing actions and complete this decisive organisation in the field of scientific and medical innovation.

Tax + donation = a launching pad to the future

Reduction of income tax :

Equal to 66% of the sums paid within the limit of 20% of taxable income.

Reduction of Wealth Tax:

In the framework of the TEPA law of 21 August 2007, amended on 6 July 2011: any physical person subject to Wealth Tax can deduct from it75% of the amount of donations made – within the limit of €50,000 a year –in favour of foundations recognised as working for the public good.

Thus a donation of €10,000 allows the donor to benefit from a tax reduction of €7,500.

This tax reduction only applies to donations in cash and to fully-owned listed securities. Donations over €50,000 do not entitle donors to carry over the surplus for reductions of Wealth Tax for succeeding years.

The fraction of the donation entitling the donor to a reduction of Wealth Tax does not entitle them to a reduction of income tax, as stipulated in article 200 of the General Tax Code.

Types of donation

- Donations of money (cash, cheque, bank transfer, direct debit, credit card),

- temporary donations of usufruct,

- donations,

- legacies,

- listed securities,

- taking out life insurance to the benefit of the Synergie Lyon Cancer Foundation.

We are a company