You are here

Support the foundation

Would you like to organise an event

or a commemoration for the benefit of Synergie Lyon Cancer?

Tax conditions for corporate donations made to foundations recognised as being in the public interest

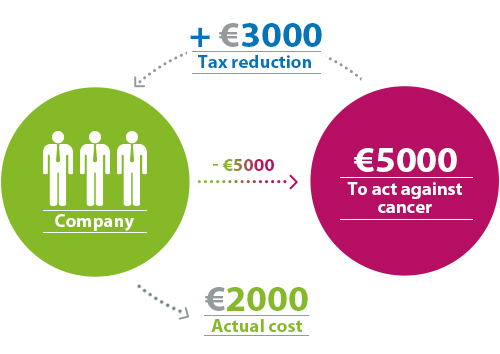

Donations made by companies to foundations acknowledged as being in the public interest entitle these companies to a tax reduction equivalent to 60% of the sums paid, provided that they do not exceed 5 ‰ of turnover.

If this threshold is exceeded, the tax administration allows the company in question to carry over the surplus for the five following years, provided that it does not exceed 5 ‰ of the turnover generated. Surpluses are imputed in the order in which they have been recorded.

Donating, means

- A commitment to solidarity

- Serving the general interest

- Imagining the future

- Engagement

- Going beyond taxation

- Being an actor in the economy and development

- Deploying one’s knowledge and knowhow

- Being a member of the community now and in the future

- Remotivated teams

- Remotivating oneself

- And more.

The different forms of sponsorship:

Financial sponsorship: the contribution of an amount in cash to a structure eligible for sponsoring. This contribution can take the form of subscriptions, subsidies, and cash payments;

Sponsorship in kind or in goods: this consists in offering free of charge goods listed on the register of tangible assets, or goods listed in stock;

Technological sponsorship is a specific type of sponsorship in kind: the technology available to, or used by, the company is mobilised to the benefit of a beneficiary working in the public interest;

Sponsorship through competences entails making available personnel free of charge to a structure eligible for sponsorship.

Thus the company proposes, within a specific framework, the free transfer of competences in favour of a project in the general interest, by making available voluntary employees during their working time.

Making employees available through sponsorship can be implemented in two ways:

- in the framework of performing a service ,

- in the framework of loaning manpower.

What sponsorship involves tax-wise

An activity is considered as sponsorship if it is limited to the simple mention of the donator’s name without the addition of any advertising message. The tax administration recognises the existence of exchange in a sponsorship operation, provided that a marked disproportion exists between the sums given and the exploitation of the service provided. The amount of exchanges is now limited by jurisprudence to 25% of the total amount to the donation.